The modified accelerated cost recovery system (MACRS):

A. Is an outdated system that is no longer used by companies.

B. Is identical to units of production depreciation.

C. Does not allow partial year depreciation.

D. Is included in the U.S. federal income tax rules for depreciating assets.

E. Is required for financial reporting.

Answer: D

You might also like to view...

Which of the following represents a permanent difference?

a. Point-of-sale revenue recognition for financial reporting purposes, installment method for tax purposes b. Goodwill amortization deducted on the tax return but not amortized for financial reporting purposes c. Straight-line depreciation for financial reporting purposes, accelerated depreciation for tax purposes d. Carryback, carryforward option for taxes, no such option for financial reporting purposes

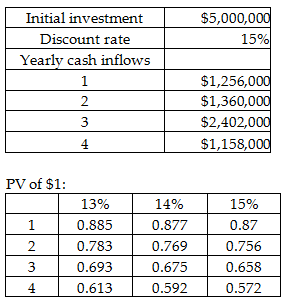

What is the NPV of the project?

The following details are provided by Ferrous Foundry Company:

A) $(636,228)

B) $590,000

C) $618,409

D) $(594,486)

A "rollover" occurs when pension accumulations are

A) paid out to retirees. B) paid out to terminated employees. C) paid out to the dependents of a deceased employee. D) transferred from one tax-deferred fund to another.

Refer to the following selected financial information from McCormik, LLC. Compute the company's days' sales in inventory for Year 2. (Use 365 days a year.) Year 2 Year 1Cash$37,500 $36,850 Short-term investments 90,000 90,000 Accounts receivable, net 85,500 86,250 Merchandise inventory 121,000 117,000 Prepaid expenses 12,100 13,500 Plant assets 388,000 392,000 Accounts payable 113,400 111,750 Net sales 711,000 706,000 Cost of goods sold 390,000 385,500

A. 43.9. B. 46.2. C. 80.0. D. 113.2. E. 42.3.