Suppose a firm's degree of financial leverage (DFL) is 1.0. Which of the following statements concerning this firm is correct?

A. The firm must have fixed costs associated with its production process.

B. The firm's earnings per share (EPS) must equal zero.

C. The firm's degree of total leverage (DTL) must equal 1.0.

D. The firm's degree of operating leverage (DOL) must be greater than 1.0.

E. The firm has no long-term debt, preferred stock, or other sources of financing that require fixed payments.

Answer: E

You might also like to view...

Express in terms of sums and differences of logarithms.logb

A.  logbx +

logbx +  - logby +

- logby +  logbz

logbz

B.  logbx +

logbx +  - logby -

- logby -  logbz

logbz

C.  logbx + 3 - 4logby - 14logbz

logbx + 3 - 4logby - 14logbz

D.  logbx ?

logbx ?  - (logby ?

- (logby ?  logbz)

logbz)

Multiply.4.5(-4.3x + 3.5y - 2.2)

A. -19.35x + 15.75y - 9.9 B. -19.35x + 3.5y - 2.2 C. -19.35x + 15.75y - 2.2 D. 19.35x + 15.75y - 9.9

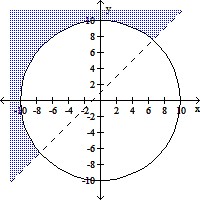

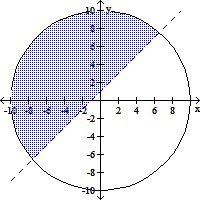

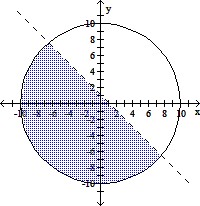

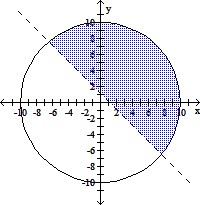

Graph the system of inequalities.x2 + y2 ? 100x + y > 1

A.

B.

C.

D.

Find the intercepts of the function f(x).f(x) = 5x4 - 9x3 + 14x2 - 18x + 8

A. x-intercepts: -2, -1, 1, -  ; y-intercept: 8

; y-intercept: 8

B. x-intercepts: -2, -1, 1,  ; y-intercept: 8

; y-intercept: 8

C. x-intercepts: 1,  ; y-intercept: 8

; y-intercept: 8

D. x-intercepts: 2,  ; y-intercept: 8

; y-intercept: 8