Taxes constitute the difference between GDP and disposable income.

Answer the following statement true (T) or false (F)

True

You might also like to view...

During a recession, the

A) cyclical rate of unemployment is positive. B) natural rate of unemployment has fallen. C) cyclical rate of unemployment is zero. D) cyclical rate of unemployment is negative.

Economist A believes that the expansionary fiscal policy --- in the form of increased government spending --- should be implemented to remove the economy from the recessionary gap it is currently in. This economist probably believes that

A) crowding out will not present much of a problem. B) crowding out will be a big problem. C) crowding out is irrelevant to the degree of effectiveness of fiscal policy. D) zero crowding out is unlikely. E) c and d

Which of the following does not contribute to a pro-business climate for investors?

A. Secure property rights. B. Minimal government regulation. C. High tax rates. D. Legalized profit.

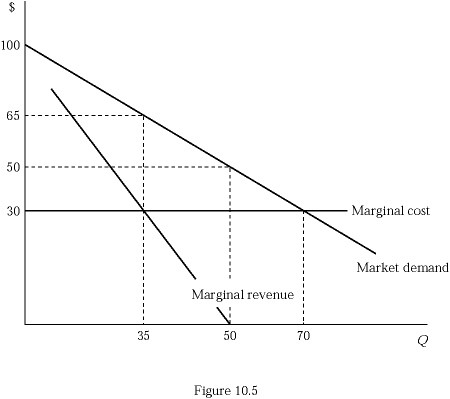

Suppose that Figure 10.5 shows an industry's market demand, its marginal revenue, and the production costs of a representative firm. If the industry was perfectly competitive, the consumer surplus would be:

Suppose that Figure 10.5 shows an industry's market demand, its marginal revenue, and the production costs of a representative firm. If the industry was perfectly competitive, the consumer surplus would be:

A. $2,450. B. $1,225. C. $612.50. D. $262.50.