Given the capital allocation line, an investor's optimal portfolio is the portfolio that

A. maximizes her expected profit.

B. maximizes her risk.

C. minimizes both her risk and return.

D. maximizes her expected utility.

E. None of the options are correct.

D. maximizes her expected utility.

By maximizing expected utility, the investor is obtaining the best risk-return relationships possible and acceptable for her.

You might also like to view...

Which of the following has the task of evaluating alternative AIS solutions?

a. AIS analysis b. AIS selection c. AIS implementation d. AIS operations

The journal entry to write down inventory to its market value results in a loss on the income statement

a. True b. False Indicate whether the statement is true or false

A statistic summarizing the strength of association between two metric variables is called the product moment correlation

Indicate whether the statement is true or false

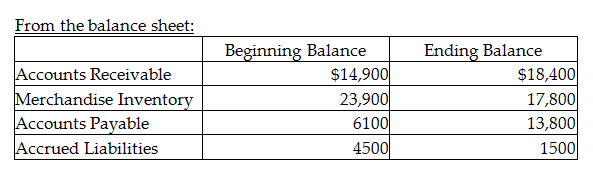

Assume that there were no sales of long-term assets, no interest revenue, and no expenses other than the expenses shown above. Also, assume that Accounts Payable are for purchases of merchandise inventory only. Accrued liabilities relate to operating expenses. What amount will be shown for the net cash provided by operating activities?

Optics Company uses the direct method for preparing its statement of cash flow. Optics reports the following information regarding 2019:

From the income statement:

Sales Revenues, $266,000

Cost of Goods Sold, $212,000

Operating Expenses, $37,000

Net Income $17,000

A) $64,300

B) $24,300

C) $17,000

D) $9300