Transfer payments are income that is

A. earned but not received.

B. received but not spent.

C. spent but not earned.

D. received but not earned.

Answer: D

You might also like to view...

Suppose, on average, a family in Church Falls earning $60,000 per year paid 6 percent of its income in state taxes. A family earning $80,000 paid, on average, $4,760 in state income taxes

Are state taxes in Church Falls progressive or regressive? Be sure to explain the difference between a progressive tax and a regressive tax.

Which of the following statements accurately describes pre-1763 British colonial policy?

a. England taxed the colonies extensively, requiring the colonists to pay a substantial portion of the costs of government administration and military protection. b. The Navigation Acts placed a severe economic burden on the colonies, equaling more than 30 percent of colonial income. c. England discouraged western settlements in an effort to reduce conflicts between colonists and Native Americans. d. Colonial laws were not officially in effect until the Privy Council granted its approval. e. All of the above statements accurately describe pre-1763 British colonial policy.

Answer the following questions true (T) or false (F)

1. The only type of business that faces limited liability is a partnership. 2. In the United States, sole proprietorship profits are taxed at the business level and then are taxed again as personal income in the form of dividend payments. 3. Corporations are legally owned by their board of directors.

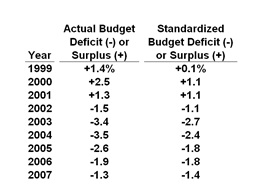

In which year was the cyclical deficit the largest?

Refer to the data in the table above.

A. 2000

B. 1999

C. 2003

D. 2004