Assuming a market interest rate of 6 percent per year, what is the present value of $5,000 payable at the end of three years?

A) $4,717

B) $4,450

C) $4,198

D) $4,317

Answer: C

You might also like to view...

The creation of a lender of last resort in the United States

A) occurred in response to banking panics. B) was mandated in the U.S. Constitution. C) occurred in response to the S&L crisis of the 1980s. D) has been recommended by the Treasury in its report of late 1992.

AZT is a drug that inhibits the reproduction of the AIDS virus, thus preventing the full development of the disease. The drug, which is sold in an unregulated market, is very expensive, and many AIDS patients who cannot afford it die from the disease. This case provides ammunition to critics of the market system on the basis of its

A. fairness. B. externalities. C. cost disease in services. D. inefficiency.

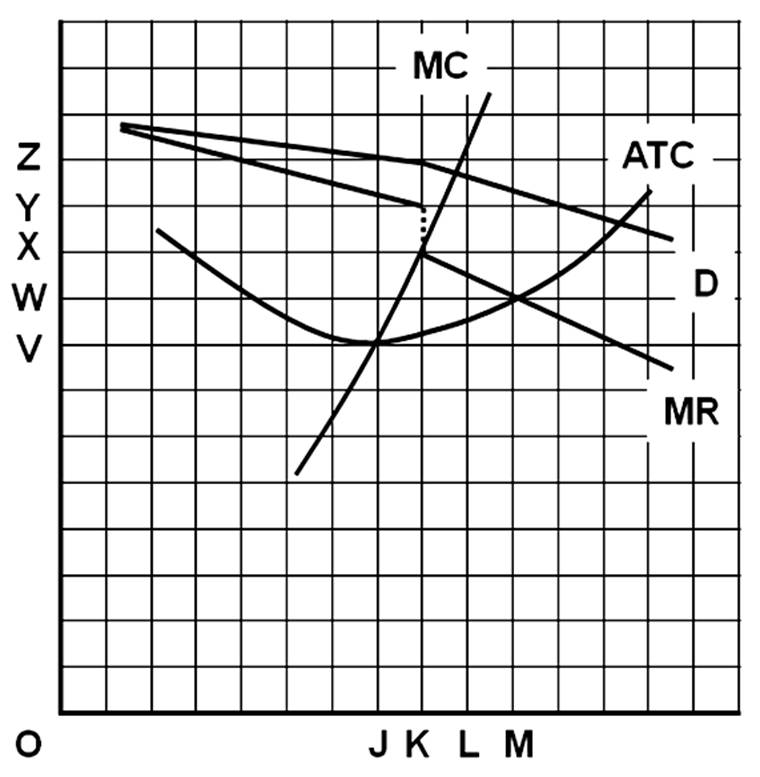

This profit-maximizing firm charges a price of

A. OV.

B. OW.

C. OX.

D. Z.

If government legislates a price floor that is below the equilibrium price

A. a shortage will develop. B. a black market will soon develop. C. a surplus will develop. D. market price and quantity sold will be unaffected.