Which of the following is the best example of an action that imposes an external cost?

a. Wear and tear on your car as the result of frequent use.

b. Deterioration in the average quality of a house you own as the result of poor maintenance.

c. Water pollution from an upstream factory that increases the cost of providing clean water to downstream residents.

d. A rose garden on your property from which your neighbor gets much enjoyment.

c

You might also like to view...

Marginal revenue product measures the

A. increase in total revenue resulting from the production of one more unit of a product. B. increase in total resource cost resulting from the hire of one extra unit of a resource. C. amount by which the extra production of one more worker increases a firm's total revenue. D. decline in product price that a firm must accept to sell the extra output of one more worker.

Which of the following serves to protect a monopoly structure?

a. appearance of close substitute goods b. creation of technologies that serve to break down barriers to entry c. continuing exclusive access to resources required to produce the good d. easier access to resources required to produce the good e. diseconomies of scale

The main difference between sales and excise taxes is that:

A. sales taxes apply to a wide range of products, while excise taxes apply only to a select group of products. B. excise taxes apply to a wide range of products, while sales taxes apply only to a select list of products. C. sales taxes are consumption taxes, while excise taxes are not. D. excise taxes are consumption taxes, while sales taxes are not.

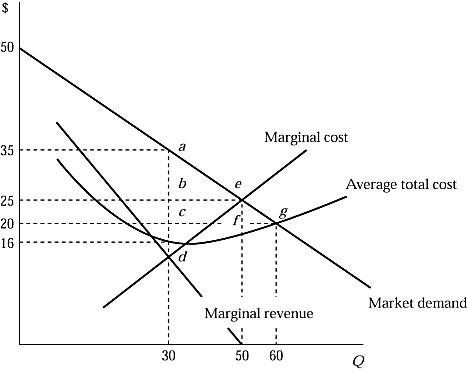

Suppose that Figure 7.4 shows an industry's market demand, its marginal revenue, and the production costs of a representative firm. If the industry was perfectly competitive, a representative firm's profit would be:

Suppose that Figure 7.4 shows an industry's market demand, its marginal revenue, and the production costs of a representative firm. If the industry was perfectly competitive, a representative firm's profit would be:

A. $1,250. B. $450. C. $250. D. There is not sufficient information.