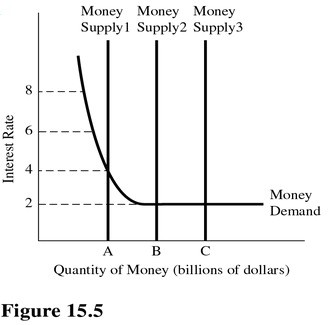

The liquidity trap illustrated in Figure 15.5 is the result of a

The liquidity trap illustrated in Figure 15.5 is the result of a

A. Currency that is not serving its function as a store of value.

B. Low opportunity cost of money.

C. Low demand for cash at low interest rates.

D. Fed ceiling on interest rates.

Answer: B

You might also like to view...

If the dollar depreciates, it can be said that

A. foreign countries no longer respect the United States. B. it falls in value within the United States. C. it takes fewer dollars to buy foreign currencies. D. other currencies appreciate.

What assumptions do economists make about the time period known as the short run?

What will be an ideal response?

Under U.S. law, foreign ________ is (are) illegal in U.S. markets

A) dumping and export subsidies B) dumping only C) export subsidies only D) None of the above are illegal

The government deficit does NOT place a burden on future generations when

A) taxes are eventually raised to pay interest on the additional debt. B) the borrowed funds are used for productive government investment. C) borrowing from foreigners offsets the deficit, so that private investment is not crowded-out. D) the borrowed funds are transferred to the purchase of nondurable consumer goods.