There are several important differences between the Fed and the European Central Bank (ECB). What are they?

What will be an ideal response?

First, the implementation of monetary policy is accomplished at all the National Central Banks (NCBs) rather than being centralized as it is in the United States (at the Federal Reserve Bank of New York). Second, the ECB's budget is controlled by the NCBs, not the other way around. This arrangement means that the NCBs control the finances of the Executive Board and its headquarters in Frankfurt. Third, in contrast to the Fed, the ECB provides liquidity mostly by lending to banks, rather than through open market purchases of securities. Fourth, the ECB typically accepts a much wider range of collateral against loans than the Fed does.

You might also like to view...

Although reserve requirements and the discount rate are not actually set by the ________, decisions concerning these policy tools are effectively made there

A) Federal Reserve Bank of New York B) Board of Governors C) Federal Open Market Committee D) Federal Reserve Banks

If the Consumer Price Index (CPI) had a value of 128 in 2007, this means that during the period between the base year and 2007:

A. All prices increased by 28 percent. B. All prices increased by an average of 1.28 percent. C. Prices of goods and services that the typical consumer buys increased by an average of 28 percent. D. Prices of goods and services that the typical consumer buys increased by an average of 128 percent.

If a union establishes by collective bargaining a wage rate that is above a competitive market equilibrium wage rate, then

A) an excess quantity of labor will be supplied.

B) a shortage of labor will result.

C) there will be an increase in total employment.

D) management will want to substitute labor for machinery.

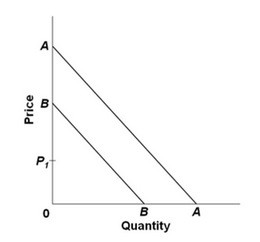

Consider the above parallel demand curves. Which curve is relatively more elastic at P1?

Consider the above parallel demand curves. Which curve is relatively more elastic at P1?

A. AA B. BB C. Cannot be determined D. Both have the same slope; therefore, both have the same elasticity.