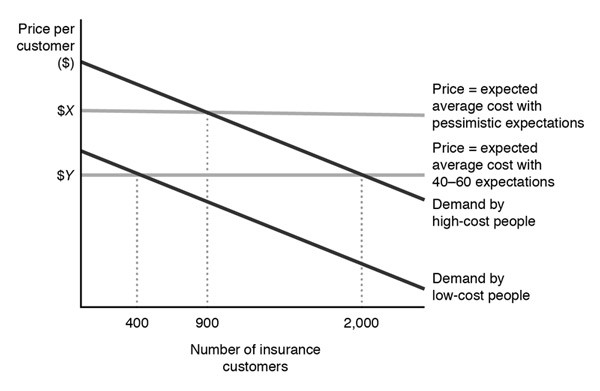

Figure 9.6 represents the market for health insurance. Suppose there are two types of consumers, low-cost consumers with $2,000 average medical expenses per year, and high-cost customers with $4,000 average medical expenses per year. Initially the insurance companies estimate that 40% of its customers are high-cost type. Compared to the outcome with pessimistic expectations, how many more customers buy health insurance?

Figure 9.6 represents the market for health insurance. Suppose there are two types of consumers, low-cost consumers with $2,000 average medical expenses per year, and high-cost customers with $4,000 average medical expenses per year. Initially the insurance companies estimate that 40% of its customers are high-cost type. Compared to the outcome with pessimistic expectations, how many more customers buy health insurance?

A. 500

B. 1,300

C. 1,500

D. 1,600

Answer: C

You might also like to view...

Due to a recent hurricane there is a major loss of sugarcane crops. At the same time in the U.S. consumers are eating healthier and cutting back on eating items that have sugar in them. How will this affect the price and quantity in the sugar market?

A. Price increases and quantity is indeterminate B. Quantity increases and price is indeterminate C. Quantity decreases and price is indeterminate D. Price decreases and quantity is indeterminate

In the above figure, suppose the economy is initially on the demand for money curve MD1. What is the effect of an increase in financial innovation such as the introduction of ATMs?

A) The demand for money curve would shift rightward to MD2. B) The demand for money curve would shift leftward to MD0. C) There would be a movement upward along the demand for money curve MD1. D) There would be a movement downward along the demand for money curve MD1.

A future payment's present value is

A) the value in today's dollars of funds to be paid or received in the future. B) the value in today's dollars of funds to be paid or received today. C) the value in a future date's dollars of funds to be paid or received today. D) the value in a future date's dollars of funds to be paid or received in the future.

The period of time over which the firm can vary any of its inputs for a given production technology is called the

A) immediate run. B) very-short run. C) long run. D) very-long run. E) short run.