Comparing an acreage allotment program versus a taxpayer-subsidized price-support program, the acreage allotment program:

A. And the price-support program have similar costs to the taxpayers

B. Imposes a smaller cost on the taxpayers

C. Imposes a larger cost on the taxpayers

D. Does not impose a cost on the consumers

B. Imposes a smaller cost on the taxpayers

You might also like to view...

Securitization is

A) the process of combining many different debt instruments like home mortgages into a pool of hundreds of thousands of individual contracts and then selling new financial instruments. B) the process of securing loans at the bank. C) the process of combining assets and debt into a pool of individual contracts and then selling new financial instruments. D) the process that FDIC uses to insure.

Suppliers with a high supply elasticity will bear a ______ tax incidence, while suppliers with a low supply elasticity will bear a ______ tax incidence

A) lower; higher B) higher; lower C) lower or no; higher or full D) A and C

You love bananas. Due to a bad crop harvest, supply of bananas dropped in half. The price for bananas is expected to double in the near future. As a result,

a. your demand for banana will increase when the price doubles b. your demand for banana increases today. c. your demand for peanut butter decreases today d. it does not affect your demand as you love bananas

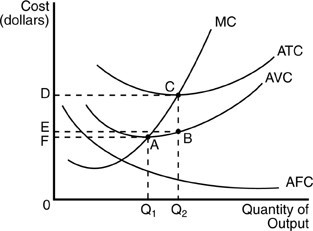

In the above figure, if this firm produces output level Q2, it has average variable costs of

In the above figure, if this firm produces output level Q2, it has average variable costs of

A. OD. B. OF. C. OC. D. OE.