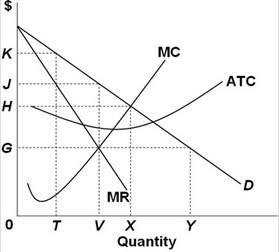

Refer to the above graph. The profit-maximizing monopolist shown sets its price at:

Refer to the above graph. The profit-maximizing monopolist shown sets its price at:

A. 0H.

B. 0K.

C. 0G.

D. 0J.

Answer: D

You might also like to view...

Suppose the San Francisco 49ers lower ticket prices by 15 percent and as a result the quantity of tickets demanded increases by 10 percent. This set of results shows that San Francisco 49ers tickets have

A) an inelastic demand. B) an elastic demand. C) a unit elastic demand. D) an inelastic supply. E) an elastic supply.

In the above figure, the demand for loanable funds curve is drawn for the average expected profit. If the real interest rate is constant at 6 percent and the expected profit falls, the amount of loanable funds demanded will be

A) less than $450 billion. B) $450 billion. C) between $450 billion and $600 billion. D) greater than $600 billion.

Ashton has the utility of wealth curve shown in the above figure. Ashton owns a sports car worth $30,000, and that is his only wealth. Ashton is a careless driver and there is a 30 percent chance that he will have an accident within a year

If he does have an accident, his car is worthless. Suppose all sports cars owners are like Ashton. An insurance company agrees to pay each person who has an accident the full value of their car. The company's operating expenses are $1,000. What is the minimum insurance premium that the company is willing to accept? A) $3,000 per year B) $6,000 per year C) $10,000 per year D) $15,000 per year

The term compensating wage differential refers to:

a. the bargaining capacity of a monoposonist in the labor market. b. the wage differences that arise from differences in the risk involved in different jobs. c. the criteria on which a firm offers a 401K plan to all its employees or just some employees. d. the wage differences that arise from difference in productivity of the workers in a firm. e. the negotiating power of the trade union.