Explain why bond prices and interest rates are inversely related

A bond is an IOU by a corporation that promises to pay the holder of the piece of paper a fixed sum at the specified maturity date and some other fixed amount of money (the coupon or interest payment) every year up to the date of maturity. Once issued, the fixed interest payment does not change. However, the interest payment on newly issued bonds may change to reflect current financial conditions. In order for an investor to be indifferent between an existing bond (issued at some interest rate) and a newly issued bond (issued at current interest rates), the price of the old bond must change to reflect current conditions. If interest rates have fallen since the old bond was issued, the interest payments for the par value of the bond are above current yields. Therefore, investors will seek to buy the bonds, and their price will increase. The price will stop increasing when the yield on older bonds equals the yield on newly issued bonds. Conversely, if interest rates have risen since the old bonds were issued, the opposite will occur, and the price of the old bonds will fall.

You might also like to view...

Which of the following is true in regards to Okun's law?

A) employment does not increase commensurately with output rises because firms tend to hoard labor B) when demand increases, firms tend to work their employees harder and longer C) it is Okun's prediction of the negative relationship between the output and unemployment gaps that allows the modern Phillips curve to be translated into the AS curve D) all of the above E) none of the above

If the equilibrium exchange rate between U.S. dollars and Japanese yen is $0.01 = 1 yen, but currently the exchange rate is $0.009 = 1 yen, then with flexible exchange rates the dollar price of a yen will __________ and the yen will __________

A) increase; appreciate B) decrease; appreciate C) increase; depreciate D) decrease; depreciate

Capital Resources

What will be an ideal response?

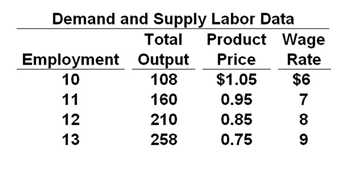

Refer to the below table. What is the marginal revenue product if the firm employs the 12th worker?

A. $19.50

B. $26.50

C. $42.50

D. $47.50