Blanca would prefer a certain income of $20,000 to a gamble with a 0.5 probability of $10,000 and a 0.5 probability of $30,000. Based on this information:

A) we can infer that Blanca neutral.

B) we can infer that Blanca is risk averse.

C) we can infer that Blanca is risk loving.

D) we cannot infer Blanca's risk preferences.

B

You might also like to view...

The idea of comparative advantage is related to

A) the idea of opportunity cost. B) the idea of absolute advantage. C) using the worker with the most diverse sets of skills. D) engineering efficiency.

Which of the following factors can partly explain the long-term growth in production in the U.S. economy?

a. Trade surpluses and accumulation of precious metals b. A gradual but consistent increase in the price level c. Growth in population d. Improvements in technology e. Federal government budget deficits

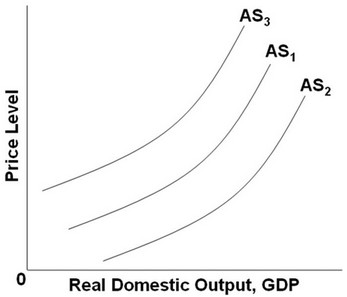

Use the following graph to answer the next question. Which of the following factors will shift AS1 to AS3?

Which of the following factors will shift AS1 to AS3?

A. A decrease in household indebtedness B. An increase in productivity C. A decrease in business taxes D. An increase in input prices

If a firm can change market prices by altering its output, then it

A. Has market power. B. Is a price taker. C. Is a competitive firm. D. Faces a horizontal demand curve.