Divide.

A.

B. -24

C. 24

D. -

Answer: C

You might also like to view...

Provide an appropriate response.Tracy invested $6000 at an interest rate of 3% for 2 years, where the interest was compounded semiannually. If A = P

calculate the accumulated amount.

calculate the accumulated amount.

A. $25,472.73 B. $12,736.36 C. $6,368.18 D. $636.82

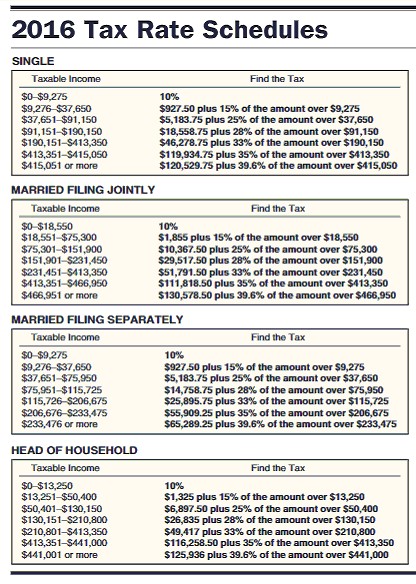

Find the tax in the following application problems. Use $4050 for each personal deduction, a standard deduction of $6300 for single taxpayers, $12,600 for married taxpayers filing jointly, $6300 formarried taxpayers filing separately, and $9300 for head of household and the tax rate schedule. Mark Collins had an adjusted gross income of $26,741 last year. He had deductions of $899 for state income tax, $555 for property tax, $2,824 in mortgage interest, and $221 in contributions. Collins claims one exemption and files as a single person.

Mark Collins had an adjusted gross income of $26,741 last year. He had deductions of $899 for state income tax, $555 for property tax, $2,824 in mortgage interest, and $221 in contributions. Collins claims one exemption and files as a single person.

A. $3,631.30 B. $1,311.15 C. $1,994.90 D. $2,356.30

Evaluate.5121/3

A. 8 B. 24 C. 12,288 D. 4096

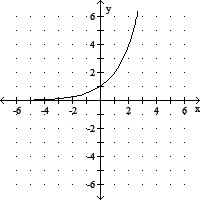

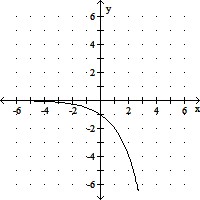

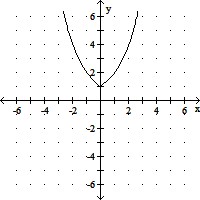

Graph the function.f(x) = 2

A.

B.

C.

D.