Panther Trust has net accounting income and distributable net income of $100,000, $75,000 from taxable sources and $25,000 from tax-exempt sources. During the year, the trust makes a mandatory distribution to Julius and Steve of $50,000 each. How much of Steve's distribution is taxable?

A. $37,500

B. $50,000

C. $12,500

D. $25,000

Answer: A

You might also like to view...

An increase in a company's revenue and expense accounts will automatically cause an increase in net income for the period

a. True b. False Indicate whether the statement is true or false

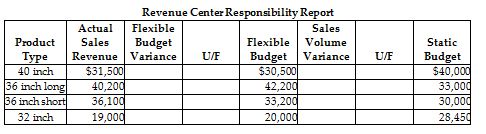

Vasquez Construction Materials Company has a sales office that sells concrete culvert pipes to property developers. The sales office is a revenue center and prepares a monthly responsibility report. The following information is provided.

What is the sales volume variance for the 36-inch long pipe?

A) $2000 U

B) $9200 F

C) $9500 U

D) $1000 F

A salesperson who handles an objection using a statement that begins with, "yes, but..." is using which method to handle customer's objections?

What will be an ideal response?

Define the terms operations and product and explain why operations is important to organizations.

What will be an ideal response?