Tax shifting

A. occurs when taxed agents can alter their behavior and do something to avoid paying a tax.

B. occurs when taxes cause prices to increase, but wages to fall.

C. is the way in which a tax is structured.

D. is the ultimate distribution of a tax's burden.

Answer: A

You might also like to view...

The self-correcting tendency of the economy means that falling inflation eventually eliminates:

A. exogenous spending. B. recessionary gaps. C. expansionary gaps. D. unemployment.

To improve package delivery, one change UPS made involved taking better account of weather forecasts to avoid delays in flying packages. This is an example of

A) positive technological change. B) diseconomies of scale. C) increasing marginal returns. D) a reduction in fixed costs.

A shift in the supply curve of bicycles resulting from higher steel prices will lead to: a. higher prices of bicycles

b. lower prices of bicycles. c. a shift in the demand curve for bicycles. d. a larger output of bicycles.

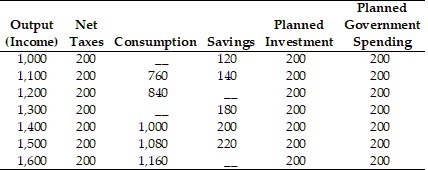

Refer to the information provided in Table 24.5 below to answer the question(s) that follow.Table 24.5All Numbers are in $ Million Refer to Table 24.5. The equilibrium level of aggregate output is $________ million.

Refer to Table 24.5. The equilibrium level of aggregate output is $________ million.

A. 1,200 B. 1,300 C. 1,400 D. 1,500