In order to expand its business, the management of Carroll, Inc issued a long-term notes payable for $50,000 on January 1, 2016

The note will be paid over a 10-year period with equal annual principal payments, December 31 of each year. The annual interest rate is 12%. Prepare the journal entry for the first installment payment.

What will be an ideal response

Interest Expense ($50,000 x 12%) 6,000

Long-Term Notes Payable ($50,000 / 10 ) 5,000

Cash 11,000

You might also like to view...

Perch Corporation has made paint and paint brushes for the past ten years. Perch Corporation is owned equally by Arnold, an individual, and Acorn Corporation. Perch Corporation has $100,000 of accumulated and current E&P. Both Arnold and Acorn Corporation have a basis in their stock of $10,000. Perch Corporation discontinues the paint brush operation and distributes assets worth $10,000 each to Arnold and Acorn Corporation in redemption of 20% of their stock. Due to the distribution, Arnold and Acorn Corporation must report:

A.

| Arnold | Acorn Corporation |

| $10,000 dividend | $8,000 capital gain |

B.

| Arnold | Acorn Corporation |

| $8,000 capital gain | $8,000 capital gain |

C.

| Arnold | Acorn Corporation |

| $8,000 capital gain | $10,000 dividend |

D.

| Arnold | Acorn Corporation |

| $10,000 dividend | $10,000 dividend |

In a short essay, list and discuss the four primary scales of measurement. Include an example of how each scale of measurement is used in marketing research

What will be an ideal response?

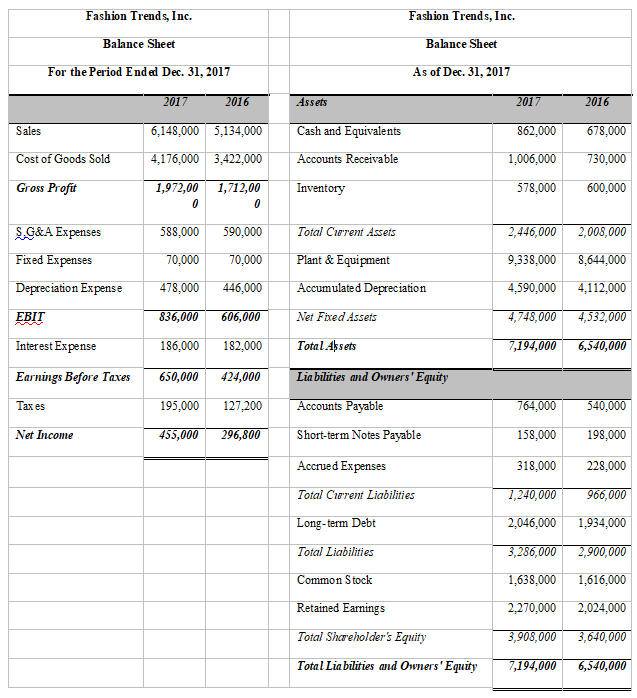

Fashion Trends, Inc., a regional fashion apparel retailer, wants to prepare a 2018 Pro Forma Income Statement and a 2018 Balance Sheet using the following 2017 and 2016 data:

The firm has forecasted sales of $7,100,000 and a tax rate of 40% for 2018. Cost of goods sold and S,G&A expense in 2018 are expected to be the average of their two-year proportion of sales. On the balance sheet, accounts receivable, inventory, accounts payable, and accrued expenses are expected to be at the two-year average of the proportion of these items in relation to sales. The firm has planned an investment of $500,000 in fixed assets in 2018, with an estimated life of 10 years and no salvage value. These fixed assets will be depreciated using the straight line depreciation method. All other financial statement items are expected to remain constant in 2018. Assume the firm pays 4% interest on short-term debt and 7% on long term debt. Assume that the dividends in 2018 will be the same as those paid in 2017.

a) What is the Discretionary Financing Needed (DFN) in 2018? Is this a surplus or deficit?

b) DFN will be absorbed by long-term debt. Set up an iterative worksheet to eliminate it.

c) Turn off iteration, and use the Scenario Manager to set up three scenarios:

1. Best Case — Sales are 15% higher than expected.

2. Base Case — Sales are exactly as expected.

3. Worst Case — Sales are 15% less than expected.

What is the DFN under each scenario?

An individual can be prosecuted by the SEC for insider trading only if that individual is employed by the company involved

Indicate whether the statement is true or false