Flamingos, Inc. has four departments. The Administrative Department costs are allocated to the other three departments based on the number of employees in each and the Maintenance Department costs are allocated to the Assembly and Packaging Departments based on their occupied space. Data for these departments follows: Admin. Maintenance Assembly Packaging Operating costs$30,000 $15,000 $70,000 $45,000 No. of employees 2 6 4 Sq. ft. of space 2,000 3,000 The total amount of the Administrative Department's cost that would eventually be allocated to the Packaging Department is:

A. $18,000.

B. $10,000.

C. $13,000.

D. $4,800.

E. $12,000.

Answer: C

You might also like to view...

The ____________________ is the ratio of earnings before interest and taxes to interest expense

Fill in the blank(s) with correct word

Through ________, marketing statisticians can extract useful information about individuals, trends, and segments from the mass of data

A) data governance B) data modeling C) data mining D) data maintenance E) data marketing

Which of the following is TRUE of the general journal?

A) All transactions recorded in one of the special journals are also recorded in the general journal. B) Manual accounting information systems do not need the general journal. C) The adjusting entries and the closing entries are recorded in the general journal. D) Non-routine transactions are generally not recorded in the general journal.

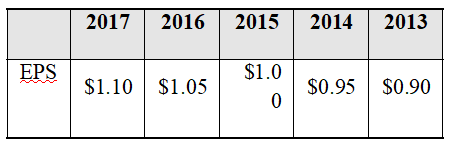

The Claustrophobic Solution, Inc., a residential window and door manufacturer, has the following historical record of earnings per share (EPS) from 2013 to 2017:

The company’s payout ratio has been 60% over the last five years and the last quoted price of the firm’s stock was $10. Flotation costs for new equity will be 7%. The company has 30,000,000 common shares outstanding and a debt-equity ratio of 0.50.

a) If dividends are expected to grow at the same arithmetic average growth rate of the last five years, what is the dividend payment in 2018?

b) Calculate the firm’s cost of retained earnings and the cost of new common equity using the constant growth dividend discount model.

c) Calculate the break-point associated with retained earnings.

d) If the Claustrophobic Solution’s after-tax cost of debt is 9%, what is the WACC with retained earnings? With new common equity?

e) Assuming that the cost of debt is constant, create a marginal cost of capital (MCC) schedule. Be sure to use a Scatter chart and make it a step function.