How do a sole proprietorship and a corporation differ?

A) Proprietorships have unlimited liability while corporations have limited liability.

B) Corporations face more taxes than do proprietorships.

C) Corporations can issue stocks and bonds, while proprietorships cannot.

D) All of these are differences between the two types of businesses.

D

You might also like to view...

Ronny's Pizza House is a profit maximizing firm in a perfectly competitive local restaurant market, and their optimal output is 80 pizzas per day. The local government imposes a new tax of $250 per year on all restaurants that operate in the city

How does this affect Ronny's profit maximizing decisions? A) No impact on the restaurant's decisions B) Ronny's will remain in business but will definitely produce less pizza C) Ronny's will definitely shut down D) Ronny's decision depends on the circumstances -- if their profits are larger than $250 per year, then the tax does not impact output; otherwise, Ronny's Pizza House will shut down.

An increase in the price of steel to producers of refrigerators will cause

A) the quantity demanded for steel to increase. B) the demand for refrigerators to decrease. C) the quantity supplied of refrigerators to increase. D) the supply curve for refrigerators to shift left.

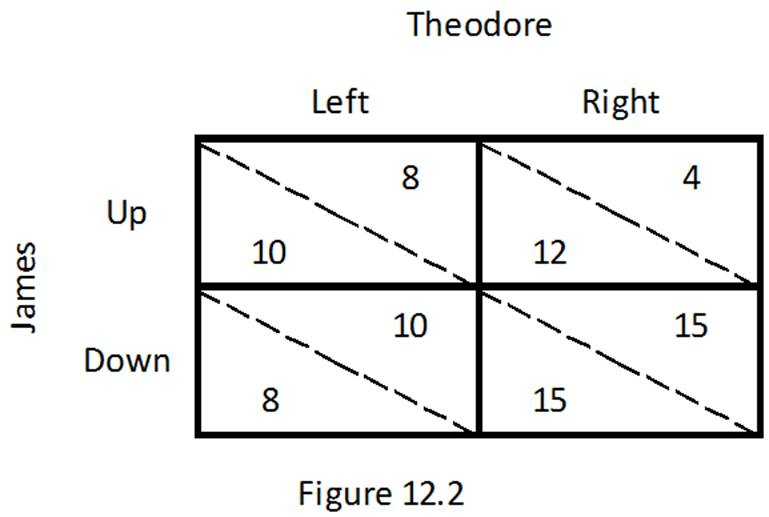

Refer to the game between James and Theodore depicted in Figure 12.2. Which of the following is true?

A. If James chooses Up, Theodore's best response is to choose Right.

B. If James chooses Down, Theodore's best response is to choose Left.

C. If Theodore chooses Left, James's best response is to choose Down.

D. If Theodore chooses Right, James's best response is to choose Down.

Economics is the study of decisions made necessary by the problem of unlimited wants and limited means to satisfy them

a. True b. False Indicate whether the statement is true or false