The federal government, in order to fund expanded health care, imposes a lump-sum tax on all business property. Profit-maximizing firms that stay in business will respond by

a. raising prices to pay the tax.

b. cutting output to reduce costs.

c. lowering prices to stimulate demand.

d. doing nothing.

d

You might also like to view...

Automatic stabilizers refer to

A) changes in the money supply and interest rates that are intended to achieve macroeconomic policy objectives. B) the money supply and interest rates that automatically increase or decrease along with the business cycle. C) changes in federal taxes and purchases that are intended to achieve macroeconomic policy objectives. D) government spending and taxes that automatically increase or decrease along with the business cycle.

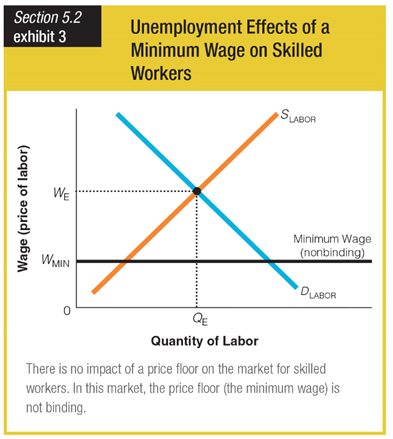

What is the effect of having a minimum wage that is nonbinding?

a. It allows wage equilibrium, but creates a quantity shortage.

b. It increased the labor shortage of workers who earn more than minimum wage.

c. It increases the labor surplus of workers who earn more than minimum wage.

d. It allows wage equilibrium and quantity equilibrium.

For the average person, insurance is

A. not a gamble. B. a useless option. C. a fair gamble. D. an unfair gamble.

If national real GDP grows at twice the rate of population growth,

A. real per capita GDP growth will double each year. B. eventually there will be too much GDP. C. real per capita GDP will double each year. D. real per capita GDP will be reduced by half each year.