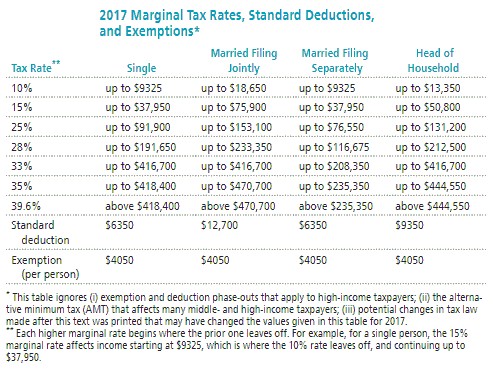

Solve the problem. Refer to the table if necessary. Carla earned wages of

Carla earned wages of  received

received  in interest from a savings account, and contributed

in interest from a savings account, and contributed  to a tax deferred retirement plan. She was entitled to a personal exemption of $4050 and had deductions totaling

to a tax deferred retirement plan. She was entitled to a personal exemption of $4050 and had deductions totaling

src="https://sciemce.com/media/4/ppg__ttttt0611190833__f1q42g5.jpg" alt="" style="vertical-align: -4.0px;" /> Find her gross income.

A. $44,771

B. $51,921

C. $33,555

D. $48,346

Answer: D

src="https://sciemce.com/media/4/ppg__ttttt0611190833__f1q42g5.jpg" alt="" style="vertical-align: -4.0px;" /> Find her gross income.

A. $44,771

B. $51,921

C. $33,555

D. $48,346

Answer: D

You might also like to view...

Answer the question.You put $192 per month in an investment plan that pays an APR of 5% compounded monthly. How much money will you have after 19 years? Compare this amount to the total amount of deposits made over the time period.

A. $72,881.41; this is $18,161.41 more than the total amount of the deposits. B. $72,834.57; this is $29,058.57 more than the total amount of the deposits. C. $72,787.79; this is $36,307.79 more than the total amount of the deposits. D. $61,909.38; this is $29,058.57 more than the total amount of the deposits.

Find a general term, (ak), that fits the displayed terms of the given sequence.1, 5, 9, 13, 17

A.

B.

C.

D.

Provide an appropriate response.Evaluate

Fill in the blank(s) with the appropriate word(s).

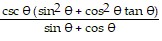

Complete the identity. = ?

= ?

A. csc2 ? + tan2 ? B. csc ? tan ? C. 1 D. sin ? + cos ?