Fiscal policy encompasses all of the following except

A) expenditures by the government.

B) monetary injection by the government.

C) taxation by the government.

D) borrowing by the government.

B

You might also like to view...

Suppose that the central bank must follow a rule that requires it to increase the money supply when the price level falls and decrease the money supply when the price level rises. If the economy starts from long-run equilibrium and aggregate demand shifts right, the central bank must

a. decrease the money supply, which will move output back towards its long-run level. b. decrease the money supply, which will move output farther from its long-run level. c. increase the money supply, which will move output back towards its long-run level. d. increase the money supply, which will move output farther from its long-run level.

In a progressive tax? system,

A. the marginal tax rate increase as income increases but the average tax rate does not change as income increases. B. the marginal tax rate and the average tax rate decrease as income levels increase and the marginal tax rate is less than the average tax rate. C. the marginal tax rate and the average tax rate are the same for every income level and the same as income increases. D. the marginal tax rate and the average tax rate increase as income levels increase and the marginal tax rate exceeds the average tax rate.

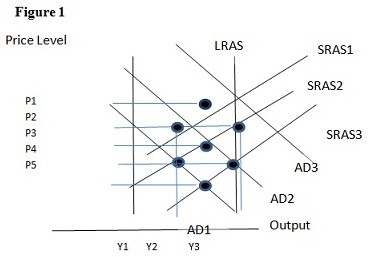

Using Figure 1 above, if the aggregate demand curve shifts from AD1 to AD2 the result in the short run would be:

A. P1 and Y2. B. P3 and Y1. C. P2 and Y2. D. P2 and Y3.

If two firms use a tit-for-tat scheme to maintain cartel pricing, and one firm chooses a low price in the current time period, then:

A. that firm will also choose a low price in the next time period. B. that firm will also choose a high price in the next time period. C. the other firm will choose a low price in the next time period. D. the other firm will choose a high price in the next time period.