In what type of analysis will an increase in the tax rate always lead to an increase in tax revenues?

A) ad valorem taxation

B) excise taxation

C) dynamic tax analysis

D) static tax analysis

Answer: D

You might also like to view...

Given the budget line in the above figure, if income is $60, then the price of a pizza is ________ and the price of a CD is ________

A) $5; $20 B) $6; $4 C) $15; 15 D) $10; $15

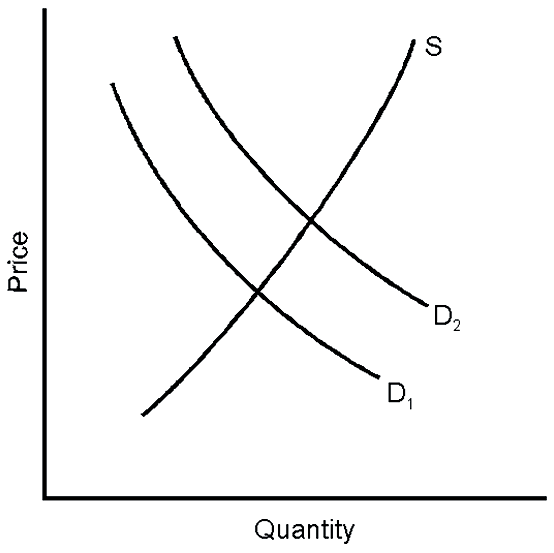

A shift from D1 to D2 causes equilibrium price to __________ and quantity to __________.

A. rise; rise

B. fall; fall

C. rise; fall

D. fall; rise

Refer to Figure 2-10. If this economy put all available resources into the production of bananas, it could produce

a. 200 bananas and also 150 baseballs. b. 300 bananas and also 100 baseballs. c. 400 bananas and no baseballs. d. It is impossible to know unless we know the quantity of resources available.

If producing a good generates pollution (a negative externality), from a social perspective

a. The price will be too low and the quantity produced will be too low b. The price will be too low and the quantity produced will be too high c. The price will be too high and the quantity produced will be too low d. The price will be too high and the quantity produced will be too high e. The price will be too low but the quantity produced will be correct