Net income for the year was $29,500 . Accounts receivable increased $2,500, and accounts payable increased$5,400 . There were no other changes in noncash current assets and liabilities. Under the indirect method, the cashflow from operations is $32,400

a. True

b. False

Indicate whether the statement is true or false

True

You might also like to view...

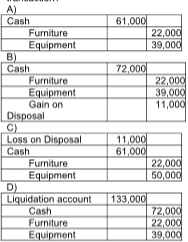

Ryan and Peter share profits in the ratio 3:2. They have decided to liquidate the partnership. They sold the furniture and equipment for $72,000. Which of the following is the correct journal entry for the sale transaction?

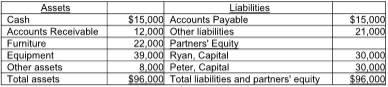

The balance sheet of Ryan and Peter's partnership as of December 31, 2018, is given below.

Renfroe, Inc. acquired 10% of Stanley Corporation on January 1, 2017, for $90,000 when the book value of Stanley was $1,000,000. During 2017, Stanley reported net income of $215,000 and paid dividends of $50,000. The book value of the 10% investment was the same as the fair value of that investment when, on January 1, 2018, Renfroe purchased an additional 30% of Stanley for $325,000. Any excess of cost over book value is attributable to goodwill with an indefinite life. During 2018, Renfroe reported net income of $320,000 and paid dividends of $50,000.How much is the adjustment to the Investment in Stanley Corporation for the change from the fair-value method to the equity method on January 1, 2018?

A. A debit of $165,000. B. A debit of $90,000. C. A debit of $16,500. D. A debit of $21,500. E. There is no adjustment.

Which of the following accounts would appear on a budgeted balance sheet?

A. Depreciation expense. B. Income tax expense. C. Sales commissions. D. Accounts receivable. E. All of the choices are correct.

In a collective bargaining agreement, the ________ clause includes the use of seniority to determine pay increases, job bidding, and the order of layoffs.

A. grievance procedure B. arbitration C. individual rights D. security E. wage component