Assume that the elasticities of supply and demand in an industry are both equal to 2 and that it is currently untaxed. A new tax imposed on the industry will:

a. be borne more by suppliers than demanders

b. be borne more by demanders than suppliers.

c. be borne equally by demanders and suppliers.

d. not raise any added revenue for the government since demand is relatively elastic.

c

You might also like to view...

In 2014, the price of peanuts was rising, which lead peanut butter sellers and peanut butter buyers to expect the price of peanut butter would rise in the future. In the current market for peanut butter, the price falls and the quantity decreases

This set of results means that A) supply decreased by more than demand increased. B) demand increased by more than supply decreased. C) demand increased by more than supply increased. D) supply decreased by more than demand decreased.

If producers must receive a higher price to be induced to produce any quantity, we can conclude that

A) supply decreased. B) demand decreased. C) both supply and demand increased. D) demand increased.

An example of a real-life rule that might constrain people's behavior is:

A. minimum wage legislation. B. having 24 hours in a day. C. the earth's limited supply of oil. D. All of these are examples of real-life rules.

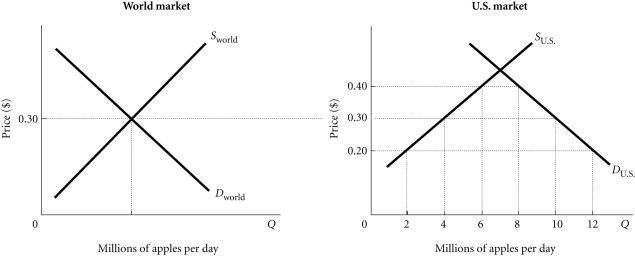

Refer to the information provided in Figure 4.1 below to answer the question(s) that follow. Figure 4.1Refer to Figure 4.1. Assume that initially there is free trade. The quantity demanded of apples will be reduced by 2 million per day if the United States imposes a tax of ________ per apple.

Figure 4.1Refer to Figure 4.1. Assume that initially there is free trade. The quantity demanded of apples will be reduced by 2 million per day if the United States imposes a tax of ________ per apple.

A. 10 cents B. 20 cents C. 30 cents D. 40 cents