Answer the following statements true (T) or false (F)

1) An increase in a lump-sum tax has the same effect on equilibrium GDP as an equal decrease in government purchases.

2) If the government increases its purchases by $200 billion but at the same time raises lump- sum taxes by $200 billion, then equilibrium GDP will remain constant.

3) A decrease in taxes will have a larger effect on equilibrium GDP if the marginal propensity to consume is smaller.

4) A recessionary expenditure gap is the amount by which aggregate expenditures must increase in order to reach the full-employment level of GDP.

1) F

2) F

3) F

4) T

You might also like to view...

Which of the following is true of an intermediate good? a. It is of no value to the seller

b. It is of no value to the buyer. c. It is purchased for household production. d. It helps produce another good. e. It is sold at a discounted price by firms.

The theory of comparative advantage shows that the gains from international trade result from producing: a. at a lower opportunity cost. b. at a lower absolute cost

c. a labor-intensive good. d. a capital-intensive good.

Which one of the following goods can be considered a global commons?

a. A National Park b. A river c. An ocean d. A herd of deer e. A diamond mine

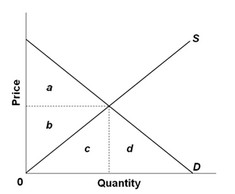

Use the figure below to answer the following question.  At equilibrium, economic surplus is represented by the area

At equilibrium, economic surplus is represented by the area

A. b + c. B. b. C. a. D. a + b.