A product is considered to be rival if

A) your consumption of the product reduces the quantity available for others to consume.

B) you can keep those who did not pay for the item from enjoying its benefits.

C) you cannot keep those who did not pay for the item from enjoying its benefits.

D) it is jointly owned by all members of a community.

A

You might also like to view...

Refer to the table above. If each country were to reduce production of its comparative disadvantage good by 1 unit, world output of wine would rise by

A) 1.5 units. B) 2 units. C) 3 units. D) 3.5 units.

A lower domestic price level tends to:

a. reduce aggregate expenditures and lower the aggregate quantity of goods and services supplied. b. reduce aggregate expenditures and lower aggregate demand. c. reduce aggregate expenditures and raise aggregate demand. d. increase aggregate expenditures and raise the aggregate quantity of goods and services demanded. e. increase aggregate expenditure on foreign goods and lower net exports.

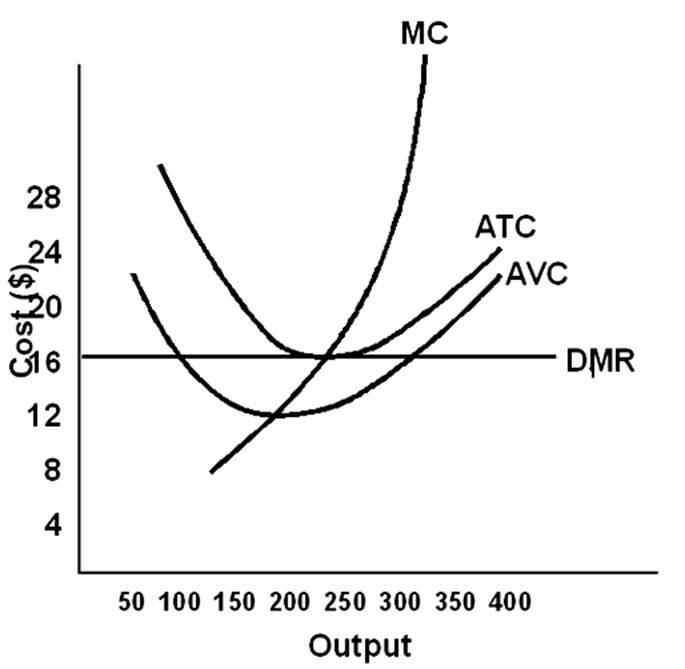

How much is the firm's output at the break-even point?

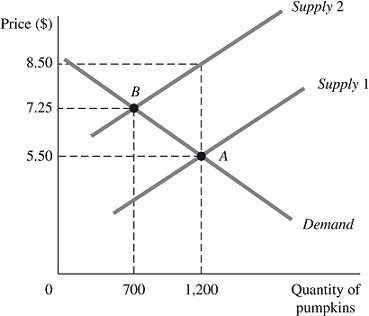

Refer to the information provided in Figure 5.7 below to answer the question(s) that follow.

Figure 5.7The above figure represents the market for pumpkins both before and after the imposition of an excise tax, which is represented by the shift of the supply curve.Refer to Figure 5.7. Had the demand for pumpkins been perfectly inelastic at Point A, the amount store owners would have received per pumpkin after the imposition and payment of this tax would have been

Figure 5.7The above figure represents the market for pumpkins both before and after the imposition of an excise tax, which is represented by the shift of the supply curve.Refer to Figure 5.7. Had the demand for pumpkins been perfectly inelastic at Point A, the amount store owners would have received per pumpkin after the imposition and payment of this tax would have been

A. $3.00. B. $5.50. C. $7.25. D. $8.50.