If the U.S. were to impose import quotas

a. the demand for loanable funds and the demand for dollars in the market for foreign-currency exchange would both increase.

b. nether the demand for loanable funds nor the demand for dollars in the market for foreign-currency exchange would increase.

c. the demand for loanable funds would increase, but the demand for dollars in the market for foreign-currency exchange would not.

d. the demand for dollars in the market for foreign-currency exchange would increase, but the demand for loanable funds would not.

d

You might also like to view...

Bette's Breakfast, a perfectly competitive eatery, sells its "Breakfast Special" (the only item on the menu) for $5.00. The costs of waiters, cooks, power, food etc. average out to $3

95 per meal; the costs of the lease, insurance and other such expenses average out to $1.25 per meal. Bette should A) close her doors immediately. B) continue producing in the short and long run. C) continue producing in the short run, but plan to go out of business in the long run. D) raise her prices above the perfectly competitive level. E) lower her output.

Martin is in the market for a new television set. He is deciding between two sets: one is rather expensive but offers a guarantee; the other has a lower price but offers no guarantee. Martin's decision to buy the expensive set would indicate that:

a. Martin does not know a good deal when he sees it. b. Martin interpreted the guarantee as a signal of quality. c. Martin did not shop around to get a better deal. d. Martin is not maximizing his utility. e. Martin has a high income.

A good that if supplied to one person is supplied to all and whose consumption by one individual does not prevent its consumption by another individual is known as:

A. an internal good. B. a public good. C. an external good. D. a private good.

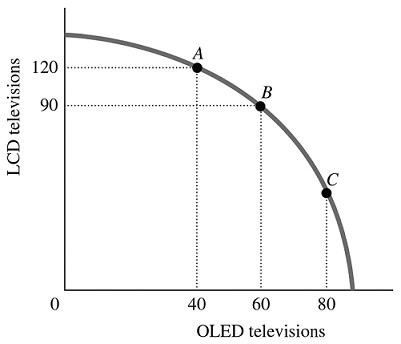

Refer to the information provided in Figure 2.5 below to answer the question(s) that follow. Figure 2.5Refer to Figure 2.5. The economy is currently at Point A. The opportunity cost of moving from Point A to Point B is the

Figure 2.5Refer to Figure 2.5. The economy is currently at Point A. The opportunity cost of moving from Point A to Point B is the

A. 30 LCD televisions that must be forgone to produce 60 additional OLED televisions. B. 90 LCD televisions that must be forgone to produce 20 additional OLED televisions. C. 30 LCD televisions that must be forgone to produce 20 additional OLED televisions. D. 120 LCD televisions that must be forgone to produce 40 additional OLED televisions.