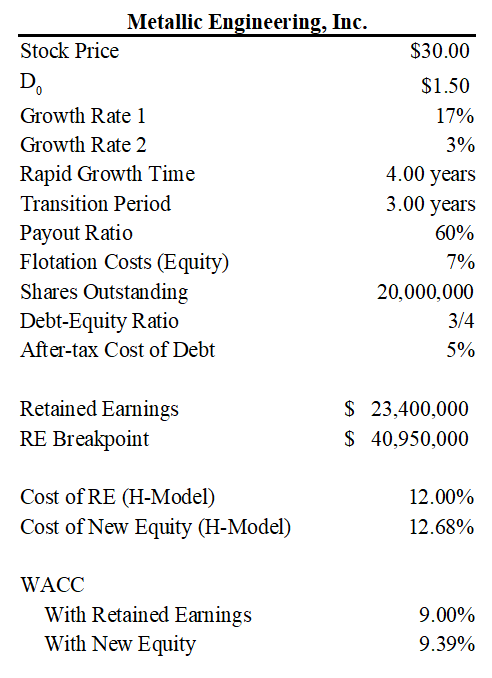

Metallic Engineering, Inc., a manufacturer of fabricated aluminum products for aerospace, engineering, automotive, and custom industrial applications, is calculating its WACC. The firm’s common stock just paid a dividend of $1.5 per share and now is selling for $30. The firm’s financial staff estimates the company’s new product will generate an unusual high dividend growth rate of 17% for four years. After this period of time, the dividend growth rate will decline to 3% during a transition period of 3 years, rather than instantaneously. The firm’s debt-to-equity ratio is 3/4 and the flotation costs for new equity will be 7%. Also, the firm has a payout ratio of 60% and 20M of common shares of stock outstanding.

a) Based on the information above, determine the firm’s estimated retained earnings and the associated break-point.

b) Calculate the firm’s cost of retained earnings and the cost of new common equity. Hint: use the required rate of return kCS derived from the H-Model formula in Chapter 9 as follows:

c) If Metallic Engineering’s after-tax cost of debt is 5%, determine the WACC with retained earnings and new common equity.

You might also like to view...

Under a modified wage plan, an employee earns $1.55 for each finished unit and is guaranteed $18 per hour as a minimum wage. If the daily quota is 96 units, on a particular day when an employee completes 90 units and works 8 hours, the amount of the make-up guarantee will be:

a. $18.00 b. $9.00 c. $4.50 d. $13.50

Shares of treasury stock are

A) issued shares that have been bought back by the corporation and are being held by the corporation. B) shares held by the U.S. Treasury Department. C) part of the total outstanding shares but not part of the total issued shares of a corporation. D) unissued shares that are held by the treasurer of the corporation.

Financial accounting is most concerned with meeting the needs of internal users

Indicate whether the statement is true or false

Always make a meeting ________________

a. plan or agenda b. entertaining c. convenient d. chart