To fully understand how taxes affect economic well-being, we must compare the

a. consumer surplus to the producer surplus.

b. price paid by buyers to the price received by sellers.

c. reduced welfare of buyers and sellers to the revenue raised by the government.

d. consumer surplus to the deadweight loss.

c

You might also like to view...

Economist Smith favors an activist monetary policy. He says that if the economy is going to be stabilized over time, it is necessary to fine-tune the money supply to the particular economic conditions that exist. What would economist Jones, who favors rules-based monetary policy, say to economist Smith?

A) Because of long lags, activist monetary policy is likely to be destabilizing rather than stabilizing. B) There have been times when activist monetary policy has worked well. C) There have been times when a constant-money-growth-rate rule has worked poorly. D) Flexibility is desirable when it comes to monetary policy.

The utility that people experience from the consumption of a good depends on

A. their income level. B. total sales of the good. C. their tastes and preferences. D. how much shopping time they spent obtaining the good.

When the demand curve is a downward sloping straight line, the slope of the marginal revenue curve is

A. the same as the slope of the demand curve. B. always equal to one. C. half as steep as the demand curve. D. twice as steep as the demand curve.

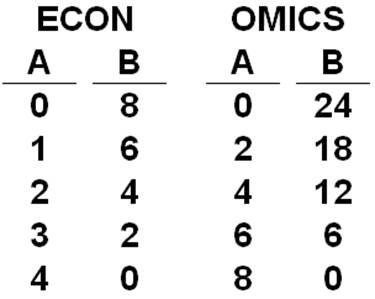

Based on the data in the tables below, you can conclude that:

Two nations, ECON and OMICS, each produce goods A and B. The table gives points on each nation's production possibilities curve.

A. OMICS has a comparative advantage in the production of good A

B. ECON has a comparative advantage in the production of good A

C. ECON has a comparative advantage in the production of good B

D. Neither ECON nor OMICS has a comparative advantage