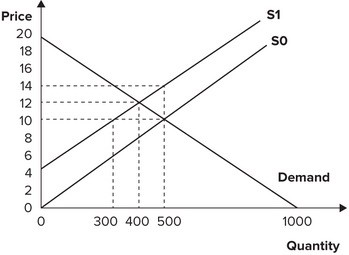

Refer to the graph shown. Assume that the market is initially in equilibrium at a price of $10 and a quantity of 500 units. If the government imposes a $4 per-unit tax on this product, it will collect tax revenue in the amount of:

A. $1,600.

B. $1,200.

C. $2,000.

D. $0.

Answer: A

You might also like to view...

Lori plans to buy a convertible this weekend. Her two favorite cars are the BMW, which would give her 160,000 utils of satisfaction, and the Mitsubishi Eclipse Spyder, which would give her only 124,000 utils of satisfaction. The BMW that she wants sells for $37,220, while the Mitsubishi sells for $28,200 . She can afford either car

a. Which car will she buy in order to maximize her utility? b. To what price will her second choice have to fall to get her to make her first choice?

Consider a market that is initially in equilibrium. If we observe that price increased and quantity decreased, then which of the following could have occurred?

a. demand increased b. supply increased c. supply decreased d. demand decreased e. both demand and supply increased

If retail managers are ordering extra merchandise from their wholesale distributors, then it is probably true that

a. total output is greater than total spending. b. price levels are decreasing. c. inventory levels are increasing. d. inventory levels are decreasing.

When considering outsourcing, most laypeople:

A. oppose it because of the visible loss of jobs. B. support it because they enjoy lower consumer prices. C. recognize its benefits to raising foreign wages. D. recognize it frees resources for other jobs for which the U.S. has a comparative advantage.