An open-market sale of T-bonds by the Fed causes the money supply to

A. fall and bond prices to fall.

B. rise and bond prices to fall.

C. rise and bond prices to rise.

D. fall and bond prices to rise.

Answer: A

You might also like to view...

Suppose the Fed has a target inflation rate of 3%, the Fed always hits its target, and the inflation rate has been 3% for several years

Furthermore, assume Amazon sets the price of its Kindle Fire at $140 in 2012 and wants to keep the real price of the Kindle constant in order to maximize profits. Now suppose that the Fed announces on January 1, 2013 that it will decrease its target rate for inflation to 1%. If Amazon has adaptive expectations, it will set its price for the Kindle in 2013 at A) $137.20. B) $140.00. C) $141.40. D) $144.20.

When a good is non-rivalrous, then there is zero marginal cost to adding an additional user

a. True b. False Indicate whether the statement is true or false

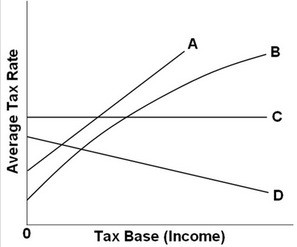

Refer to the above graph. Which of the lines in the above diagram represent(s) a regressive tax?

Refer to the above graph. Which of the lines in the above diagram represent(s) a regressive tax?

A. Both A and B B. B only C. C only D. D only

Which of the following statements concerning economic models is FALSE?

A) Economic models must provide usable predictions. B) Economic models are based on data alone and no assumptions. C) Economic models are tested empirically. D) Economic models relate to how people behave.