Financial risk refers to the extra risk stockholders bear as a result of using debt as compared with the risk they would bear if no debt were used.

Answer the following statement true (T) or false (F)

True

You might also like to view...

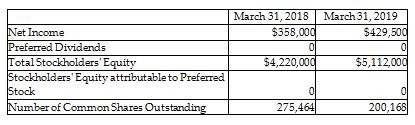

Rather Corporation's annual report is as follows.

If the current market price is $17 on March 31, 2019, compute the price/earnings ratio on March 31, 2019. (Round any intermediate calculations and your final answer to the nearest cent.)

A) 9.39

B) 2.15

C) 1.81

D) 7.91

Which of the following strands of OD is presently utilized, specifically in mergers and acquisitions?

a. Action research b. Quality and employee involvement c. Organizational culture d. Organizational learning

The leftover inventory from previous periods that is available at the start of a period is called ______.

a. leftover inventory b. projected available balance c. on-hand inventory d. available to promise

Bob has a $50,000 stock portfolio with a beta of 1.2, an expected return of 10.8%, and a standard deviation of 25%. Becky also has a $50,000 portfolio, but it has a beta of 0.8, an expected return of 9.2%, and a standard deviation that is also 25%. The correlation coefficient, r, between Bob's and Becky's portfolios is zero. If Bob and Becky marry and combine their portfolios, which of the following best describes their combined $100,000 portfolio?

A. The combined portfolio's expected return will be less than the simple weighted average of the expected returns of the two individual portfolios, 10.0%. B. The combined portfolio's beta will be equal to a simple weighted average of the betas of the two individual portfolios, 1.0; its expected return will be equal to a simple weighted average of the expected returns of the two individual portfolios, 10.0%; and its standard deviation will be less than the simple average of the two portfolios' standard deviations, 25%. C. The combined portfolio's expected return will be greater than the simple weighted average of the expected returns of the two individual portfolios, 10.0%. D. The combined portfolio's standard deviation will be greater than the simple average of the two portfolios' standard deviations, 25%. E. The combined portfolio's standard deviation will be equal to a simple average of the two portfolios' standard deviations, 25%.