Supply-side economists contend that the system of taxation in the United States:

A. Creates incentives to save and invest

B. Creates dis-incentives to work

C. Generates maximum tax revenue

D. Reduces the effects of cost-push inflation

B. Creates dis-incentives to work

You might also like to view...

Over the past century in the United States, average income as measured by real GDP per person has grown about

a. 3.5 percent per year, which implies a doubling about every 20 years. b. 2 percent per year, which implies a doubling about every 35 years. c. 4 percent per year, which implies a doubling about every 17.5 years. d. None of the above is correct.

In the short run, if the economy is at full employment, then the quantity of real GDP

A) is equal to potential GDP, and the unemployment rate is equal to the natural unemployment rate. B) does not necessarily equal potential GDP, but the unemployment rate is equal to the natural unemployment rate. C) is equal to potential GDP, but the unemployment rate does not necessarily equal the natural unemployment rate. D) is equal to potential GDP, but the unemployment rate is less than the natural unemployment rate. E) exceeds potential GDP, and the unemployment rate is less than the natural unemployment rate.

Under the original Clayton Act, which of the following was not illegal?

a. Charging different prices for the same product. b. Exclusive dealer agreements. c. The purchase of the stock of a rival firm that lessens competition. d. The purchase of the assets of a rival firm that lessens competition.

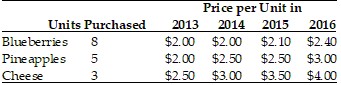

Refer to the information provided in Table 22.5 below to answer the question(s) that follow.

Table 22.5 Refer to Table 22.5. Suppose 2015 is the base year. The price index in 2014 is

Refer to Table 22.5. Suppose 2015 is the base year. The price index in 2014 is

A. 94.2. B. 97.4. C. 106.1. D. 123.0.