To make things simpler and focus attention on what really matters, economists:

A. use assumptions.

B. ignore all variables.

C. think at the margin.

D. respond to incentives.

Answer: A

You might also like to view...

Capital gains are

A. the amount of income a taxpayer has after taxes are paid. B. total sales prices from assets. C. any profit you have from asset sales. D. total net income from all sources.

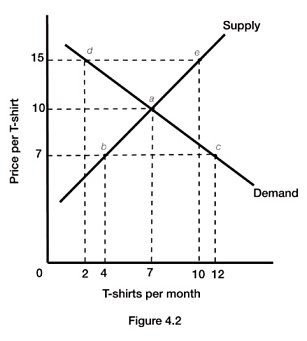

Figure 4.2 illustrates the supply and demand for t-shirts. If the actual price of t-shirts is $15, there is an:

Figure 4.2 illustrates the supply and demand for t-shirts. If the actual price of t-shirts is $15, there is an:

A. excess demand of 8 t-shirts. B. excess supply of 8 t-shirts. C. excess demand of 10 t-shirts. D. excess supply of 10 t-shirts.

The price elasticity of demand can be computed as

A. change in total utility/change in quantity.

B.

| percentage change in quantity demanded/percentage change in price. |

C. change in price/change in quantity demanded.

D. change in quantity demanded/change in price.

Most goods can be classified as normal goods rather than inferior goods. The definition of a normal good suggests that:

A. The income elasticity of demand for the good is negative B. The price elasticity of demand for the good is negative C. The income elasticity for the good is greater than 0 D. The cross elasticity of demand for the good is positive