Cal has a choice between two gambles. The first gamble offers a 50 percent chance of winning $20 and a 50 percent chance of losing $20. The second gamble offers a 20 percent chance of winning $100 and an 80% chance of losing $20. Which choice has the higher expected value?

A. The expected value of both gambles is the same, but Cal would prefer the first gamble since the chances of winning are higher.

B. The expected value of the first gamble is higher.

C. The expected value of the second gamble is higher.

D. The expected value of both gambles is the same, so Cal would be indifferent between the two.

Answer: C

You might also like to view...

What Causes Rates to Change?

The short-run Phillips curve is downward sloping because

A) the expected inflation rate is zero in the short run. B) the economy always returns to full employment. C) reducing the unemployment rate will reduce the inflation rate in the short run. D) in the long run, the expected inflation rate equals the actual inflation rate. E) the unemployment rate can be above or below the natural unemployment rate.

Suppose there's an 80% chance of a stock rising by 20% and a 20% chance of it falling by 40%. What is the expected rate of return on the stock?

A) -40% B) -20% C) 8% D) 16%

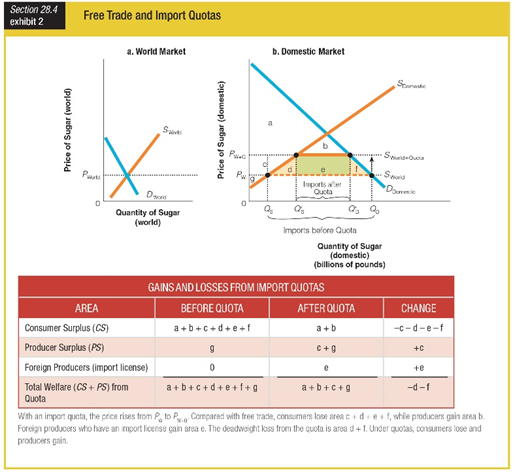

How is the total welfare resulting from import quotas on sugar affected as shown in Exhibit 2?

a. gain of area e

b. gain of area c

c. loss of areas c, d, e, and f

d. loss of areas d and f