Suppose that in the market for paper, demand is p = 100 - Q. The private marginal cost is MCp = 10 + Q. Pollution generated during the production process creates external marginal harm equal to MCe = Q. What specific tax would result in a competitive market producing the socially optimal quantity of paper?

What will be an ideal response?

The socially optimal quantity of paper is found by setting MCp + MCe = p or 10 + Q + Q = 100 - Q. Rearranging yields Q = 30. At this level of output society incurs an external cost of 30. This is the specific tax that would yield the socially optimal quantity. To check, set MCp + tax = 100 - Q. This yields Q = 30.

You might also like to view...

In an oligopoly, firms can increase their market power by

A) undertaking heavy advertising expenditure. B) colluding to set prices. C) selling to buyers who have market power. D) pursuing dominant strategies.

Holding other factors constant, a decrease in the tax for producing cars causes

a. The supply curve to shift to the left, causing the prices of coffee to rise b. The supply curve to shift to the right, causing the prices of coffee to rise c. The supply curve to shift to the left, causing the prices of coffee to fall d. The supply curve to shift to the right, causing the prices of coffee to fall

Which of the following statements is true about efficiency wages?

a. Efficiency wages reduce monitoring cost of the employer. b. Employees benefit more from efficiency wages than employers. c. Productivity of the employee is usually unaffected by efficiency wages. d. Loafing is more rewarding for employees who earn efficiency wages.

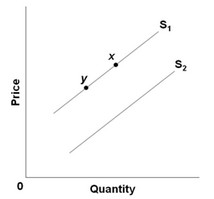

Use the figure below to answer the following question. A movement along the supply schedule from point x to point y depicts

A movement along the supply schedule from point x to point y depicts

A. a decrease in supply. B. an increase in quantity supplied. C. a decrease in quantity supplied. D. an increase in supply.