Financial intermediaries are institutions that facilitate the movement of funds from savers to investors because they

A) guarantee positive returns on investments.

B) eliminate the costs of negotiating such transactions.

C) eliminate risks.

D) provide liquidity.

D

You might also like to view...

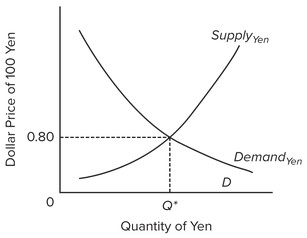

Use the following graph to answer the next question. Assume that Japan and the United States are engaged in a system of flexible exchange rates. If more people in the United States decide to purchase Japanese cars, what effect will this have on the market for yen?

Assume that Japan and the United States are engaged in a system of flexible exchange rates. If more people in the United States decide to purchase Japanese cars, what effect will this have on the market for yen?

A. The supply of yen will decrease. B. The price of yen will increase. C. The supply of yen will increase. D. The price of yen will decrease.

In the above figure, the axis break in the x-axis

A) reflects the fact that for the years covered in the figure, the unemployment rate was never less than 3 percent. B) shows that there is no relationship between inflation and unemployment. C) misleadingly shows that inflation has changed very little even though the unemployment rate has increased a great deal. D) implies that for the years covered in the figure, the inflation rate was always greater than 1 percent.

Which of the following measures absolute poverty?

A. Median income B. The lower quintile of income C. The poverty line D. The poverty standard

Which statement is false?

A. All oligopolies have only a few firms. B. Most firms in the United States are oligopolies. C. Administered prices are most likely to occur under oligopoly. D. In all market structures, price is always read off the demand curve.