________ occurs when households can alter their behavior and do something to legally avoid paying a tax.

A. Tax evasion

B. Tax incidence

C. Tax depreciation

D. Tax shifting

Answer: D

You might also like to view...

Haiti was once heavily forested. Today, 80 percent of Haiti's forests have been cut down, primarily to be burned to create charcoal. The reduction in the number of trees has led to devastating floods when it rains heavily. This is an example of

A) the tragedy of the commons. B) tragic externalities. C) human greed. D) the consequences of too many people having private property rights.

The past two decades has seen a steady increase in the share of total taxes paid by high-income groups

a. True b. False

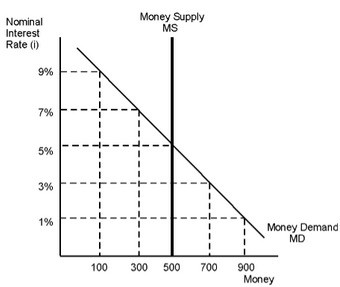

Refer to the given figure. If the Federal Reserve wants to set the nominal interest rate at 9 percent, it must conduct open market ________ to set the money supply at ________.

If the Federal Reserve wants to set the nominal interest rate at 9 percent, it must conduct open market ________ to set the money supply at ________.

A. sales; 900 B. sales; 100 C. purchases; 900 D. purchases; 100

One key purpose of economic regulation is

A) to force a firm to produce at the point at which marginal cost equals marginal revenue. B) to control the quality of service provided by a monopolist. C) to control the price that regulated enterprises are allowed to charge. D) to focus on the impact of production on the environment and society, the working conditions under which goods and services are produced, and sometimes the physical attributes of goods.