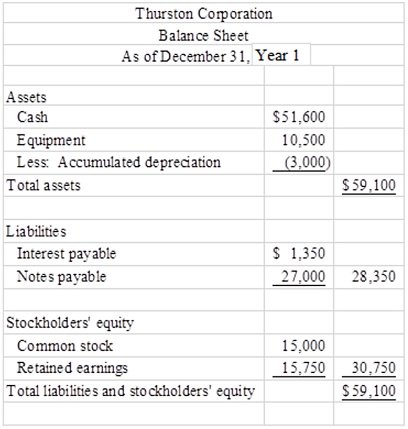

Thurston Company started its business on January 1, Year 1 by issuing $15,000 of common stock. On January 1, the company purchased equipment for $10,500. The equipment is estimated to have a three-year useful life and a $1,500 salvage value. On March 1, Thurston issued a $27,000, 6% five-year note to Community Bank. Customers paid Thurston $54,000 for services performed in Year 1. The company paid $33,000 for operating expenses, and paid a $900 dividend to the stockholders. At year-end, Thurston recognized interest expense on the note and depreciation expense on the equipment.Required:a) What is the amount of interest expense Thurston will recognize in Year 1?b) What is the book (carrying) value of the equipment at the end of Year 1?c) What is the net income for Year 1?d) Prepare a

balance sheet as of the end of Year 1.

What will be an ideal response?

a) $1,350

b) $7,500

c) $16,650

d)

a) Year 1 Interest expense = Principal of $27,000 × 6% × 10/12 = $1,350

b) Year 1 Depreciation expense = (Cost of $10,500 ? Salvage value of $1,500) ÷ Useful life of 3 years = $3,000; Book value = Cost of $10,500 ? Accumulated depreciation of $3,000 = $7,500

c) Net income = $54,000 ? ($33,000 + $3,000 + $1,350) = $16,650

You might also like to view...

Discuss what employers look for during an interview

What will be an ideal response?

The decision made by a/an ______ is legally binding for all parties.

A. mediator B. arbitrator C. intermediary D. conciliator

What does market targeting involve?

What will be an ideal response?

Which is true about large service desks?

A. Unlike small service desks, they have trouble providing training for analysts, as analysts spend the majority of their time working with customers. B. They tend to be people-dependent and are severely affected when someone leaves the company or is out because of illness or vacation. C. Many grew from small service desks whose support needs increased or were consolidated from several smaller service desks. D. They have more than 25 people but focus on analysts getting to know their customers, relating well to them, and fully understanding their needs.