The operating income calculated using variable costing and absorption costing amounted to $9100 and $11,200, respectively. There were no beginning inventories. Determine the total fixed manufacturing overhead that will be expensed under absorption costing for the year.

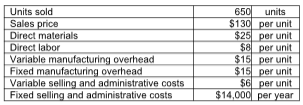

Locklear, Inc. reports the following information for the year ended December 31:

A) $11,850

B) $9750

C) $26,000

D) $31,200

B) $9750

Under absorption costing, fixed manufacturing overhead is treated as a product cost and is

expensed when the units sold are sold.

Therefore, total fixed manufacturing overhead cost expensed under absorption costing = 650 units × $15

per unit = $9750

You might also like to view...

Information sources that are generated for the particular problem being studied are best described as:

A) primary sources. B) secondary sources. C) quantitative sources. D) qualitative sources.

Section 404 requires management to make a statement identifying the control framework used to conduct their assessment of internal controls. Discuss the options in selecting a control framework

Which of the following is a feature of Trade Related Aspects of International Property Rights (TRIPS)?

A) It mandates that patents must be protected for at least 30 years. B) It requires industrial designs to be protected for at least 25 years. C) Under it, countries have the right not to patent different processes, such as surgical methods. D) It prohibits countries from issuing compulsory licenses to force production of a patented product, even if the patent holder's rights are protected.

The quick ratio although similar to the current ratio is more conservative.

Answer the following statement true (T) or false (F)