If the federal government placed a 50 cent per pack excise tax on cigarette manufacturers, and if as a result, the price to consumers of a pack of cigarettes went up by 40 cents, the

a. actual burden of this tax falls mostly on consumers.

b. actual burden of this tax falls mostly on manufacturers.

c. actual burden of the tax would be shared equally by producers and consumers.

d. tax would clearly be a progressive tax.

A

You might also like to view...

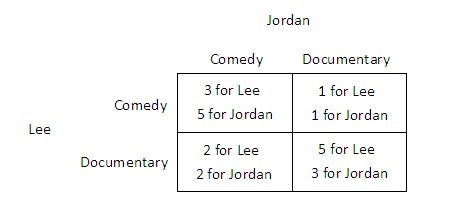

Suppose Jordan and Lee are trying to decide what to do on a Friday. Jordan would prefer to see a comedy while Lee would prefer to see a documentary. One documentary and one comedy are showing at the local cinema. The payoffs they receive from seeing the films either together or separately are shown in the payoff matrix below. Both Jordan and Lee know the information contained in the payoff matrix. They purchase their tickets simultaneously, ignorant of the other's choice.  Which of the following statements is true?

Which of the following statements is true?

A. For Lee, seeing a documentary is a dominant strategy. B. Lee does not have a dominant strategy. C. Lee's dominant strategy depends on Jordan's choice. D. For Lee, seeing a comedy is a dominant strategy.

Which of the following best reflects an increase in quantity demanded and not an increase in demand?

A) A college expects enrollment to increase, despite no change in the tuition. B) Skiing becomes a fashionable winter sports activity. C) The price of hair stylings falls. D) Consumers expect lower prices next month for computers.

Firms under-invest in safety because

A) firms are not concerned with safety. B) firms do not want their plants to be safe. C) firms are risk averse. D) firms do not enjoy all of the benefits from investments in safety.

The government performs each of the following economic functions except

A. collecting taxes. B. spending. C. issuing regulations. D. operating the price mechanism.