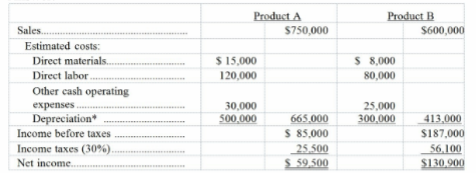

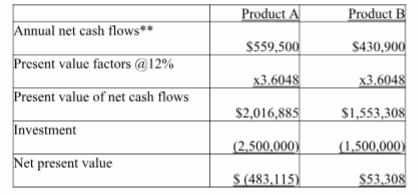

The company has a 30% tax rate and it uses the straight-line depreciation method. The present value of an annuity of 1 for 5 years at 12% is 3.6048. Compute the net present value for each piece of equipment under each of the two product lines. Which, if either of these two investments is acceptable?

A company is trying to decide which of two new product lines to introduce in the coming

year. The company requires a 12% return on investment. The predicted revenue and cost data

for each product line follows:

*Annual depreciation: A $2,500,000/5 yrs. = $500,000; B $1,500,000/5 yrs. = $300,000

**Product A: $59,500 + $500,000 = $559,500; Product B: $130,900 + $300,000 = $430,900

Product A is not acceptable since its NPV is less than zero. Product B is acceptable since its

NPV is greater than zero.

You might also like to view...

The IRR method assumes that cash flows are reinvested at:

A) the internal rate of return of the original investment. B) the company's discount rate. C) the lower of the company's discount rate or internal rate of return. D) an average of the internal rate of return and the discount rate.

In a shipment contract, delivery occurs when the shipment reaches the destination

Indicate whether the statement is true or false

Megan wants to start a company that makes handmade products. She has limited capital, and she does not want to spend it on maintaining a large inventory of raw materials. She plans to maintain only two weeks' worth of stock of finished goods as she does not want to end up with a large inventory of products that may not sell. Which of the following production systems would be most suitable for Megan's company?

A. The push system of inventory control B. The mass production system C. The just-in-time production system D. The continuous production system

Income Statement accounts are also called:

A. Permanent accounts B. Temporary accounts C. Equity accounts D. None of the choices are correct