The Modigliani and Miller hypothesis suggests that capital structure doesn't matter. All of the

following conditions need to be met for this hypothesis to be true EXCEPT

A) all corporate net income is paid out as dividends.

B) corporate income is not subject to taxation.

C) capital structure consists only of stocks and bonds.

D) securities are traded in perfect or efficient markets.

A

You might also like to view...

Which of the following is the third step of the performance success cycle?

a. assess b. talk c. think d. coach

Which of the following is true with regard to price fixing?

A) Price fixing is a reasonable violation of Section 1 of the Sherman Act. B) Price fixing is a process seen exclusively among sellers of goods and services. C) Price fixing is permissible as it helps consumers or protects competitors from ruinous competition. D) Price fixing also involves fixing the quantity of a product or service to be produced or provided.

Markov analysis provides information on the probability of customers switching from one brand to one or more other brands

Indicate whether this statement is true or false.

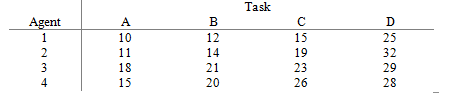

Use the Hungarian method to obtain the optimal solution to the following assignment problem in which total cost is to be minimized. All tasks must be assigned, and no agent can be assigned to more than one task.

What will be an ideal response?