The City of Richmond maintains a Public Employee Retirement Trust Fund for its public safety employees. During the year ended June 30, 2017, the following transactions occurred:1.The City contributed $ 1,200,000 in cash to the plan. Employee members contributed an additional $ 1,200,000.2.Annuity benefits in the amount of $255,000 were recorded as liabilities.3.Annuity benefits, previously recorded as liabilities, were paid in cash in the amount of $207,000.4.Investment income received in cash amounted to $102,000. In addition, $16,000 in interest receivable was accrued at year-end.5.Additional investments in the amount of $2,100,000 were purchased.6.The market value of investments decreased by $9,100.7.Nominal accounts for the year were closed.Required: Prepare journal entries for

the above transactions on the books of the City of Richmond Public Safety Employee Retirement Trust Fund.

What will be an ideal response?

| CITY OF RICHMOND |

| PUBLIC SAFETY EMPLOYEE RETIREMENT TRUST FUND |

| YEAR ENDED JUNE 30, 2017 |

| ? | Debits | Credits |

| 1 | Cash | 2,400,000 |

| Additions - Contributions-Plan Members | 1,200,000 |

| Additions - Contributions-Employer | 1,200,000 |

| 2 | Deductions - Annuity Benefits | 225,000 |

| Accounts Payable and Accrued Expenses | 225,000 |

| 3 | Accounts Payable and Accrued Expenses | 207,000 |

| Cash | 207,000 |

| 4 | Cash | 102,000 |

| Accrued Interest Receivable | 16,000 |

| Additions - Investment Earnings Interest | 118,000 |

| 5 | Investments | 2,100,000 |

| Cash | 2,100,000 |

| 6 | Deductions- Investments: Net Decline in the Fair |

| Value of Investments |

| Investments | 9,100 |

| ? | 9,100 |

| 7 | Additions - Contributions-Plan Members | 1,200,000 |

| Additions - Contributions-Employer | 1,200,000 |

| Additions - Investment Earnings Interest | 118,000 |

| Deductions - Investments: Decline in Fair |

| Value of Investments | 9,100 |

| Deductions - Annuity Benefits | 225,000 |

| Net Position: Resources Restricted for |

| Pension Benefits | 2,283,900 |

You might also like to view...

According to the 2011 Customer Engagement Report created by Razorfish, real-time chats with customer service representatives engage customers the best out of all channel categories

Indicate whether the statement is true or false

________ profit is simply the profit margin a company earns from an average customer

A) Supplementary B) Base C) Complementary D) Variable

A(n) ________ identifies how much cash is needed to meet financial obligations and the source of that cash

A) business statement B) income statement C) capitalization statement D) cash-flow statement E) balance sheet

Answer the following statements true (T) or false (F)

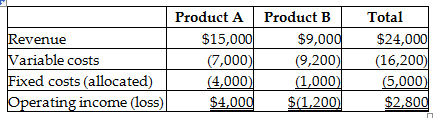

A company has two different products that sell to separate markets. Financial data are as follows:

Assume that fixed costs are all unavoidable and that dropping one product would not impact sales of the other. Because the contribution margin of Product B is negative, it should be dropped.