Suppose all firms in a competitive market are currently in both short-run and long-run equilibrium. What impact will a lump sum tax have on each firm in the short run? in the long run?

What will be an ideal response?

In the short run, the lump sum tax represents a fixed cost. The firm's output decision is unchanged, but its profits decrease. In the long run, the tax raises the LRAC of each firm, but not MC. Minimum AC is higher, so price is higher. With a higher price, each firm produces a greater quantity, but the higher price means less quantity is demanded in total; thus, the number of firms will decrease.

You might also like to view...

In which of the following countries does health insurance not pay for most preventive care procedures?

A) Canada B) Japan C) the United Kingdom D) the United States

A college education is a(n)

a. investment in human capital. b. form of innovation. c. public good. d. mediated settlement.

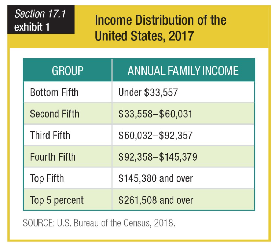

Mo’s family earns $200,000 per year. Based on the table showing income distribution in the United States in 2017, they are in the ______.

a. third fifth

b. fourth fifth

c. top fifth

d. top 5%

Figure 19-2

?

A. 1 B. 2 C. 3 D. 4