Suppose the value of income elasticity of demand for a private college education is equal to 1.5 . This means that

a. every $1 increase in income provides an incentive for a $1.50 increase in expenditures on private college education.

b. every $1.50 increase in income provides an incentive for a $1 increase in expenditures on private college education.

c. a 10 percent increase in income causes a 15 percent increase in the quantity of private college education purchased.

d. a 15 percent increase in income causes a 10 percent increase in the quantity of private college education purchased.

e. a 10 percent decrease in private college tuition will have a large enough income effect to increase spending on private college education by 15 percent.

C

You might also like to view...

Explain why it might be necessary in some circumstances for firms to pay workers wages that are higher than the legislated minimum wage even for jobs requiring low skills

What will be an ideal response?

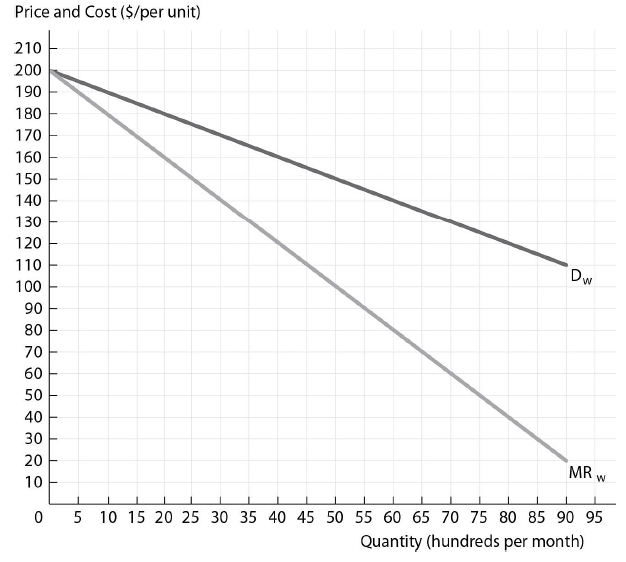

Slick Shades has a constant marginal cost of production equal to $40 and the distributors have a constant marginal cost of distribution equal to $20. If Slick Shades is producing the profit-maximizing number of sunglasses (in hundreds), what is the profit-maximizing wholesale price?

The figure above shows the wholesale demand and marginal revenue curves for Slick Shades Sunglasses, a sunglasses firm with market power. Slick Shades Sunglasses has a constant marginal cost of production and it sells to perfectly competitive independent retail distributors that have a constant marginal cost of distribution.

A) $110

B) $120

C) $140

D) $130

The federal minimum wage automatically increases every year for inflation

Indicate whether the statement is true or false

Constant returns to scale occur when a firm's

a. marginal costs are constant as output increases. b. long-run average total costs are decreasing as output increases. c. long-run average total costs are increasing as output increases. d. long-run average total costs do not vary as output increases.