After a tax is imposed,

a. consumers pay a higher price

b. consumers lose consumer surplus.

c. producers lose producer surplus.

d. all of the above are true.

d

You might also like to view...

Jose consumes wallets (q1 ) and a composite of other goods (q2 ). The price of wallets is p1 and the price of other goods is p2 = 1

Jose's utility from wallets depends also on his income—with a higher income, he values a wallet more because he has more to put inside it! His utility is given by the equation U(q1,q2 ) = q1Yq2 Derive Jose's demand for wallets.

In practice, a corporation is usually controlled by its

a. competitors b. managers c. stockholders d. economists e. bondholders

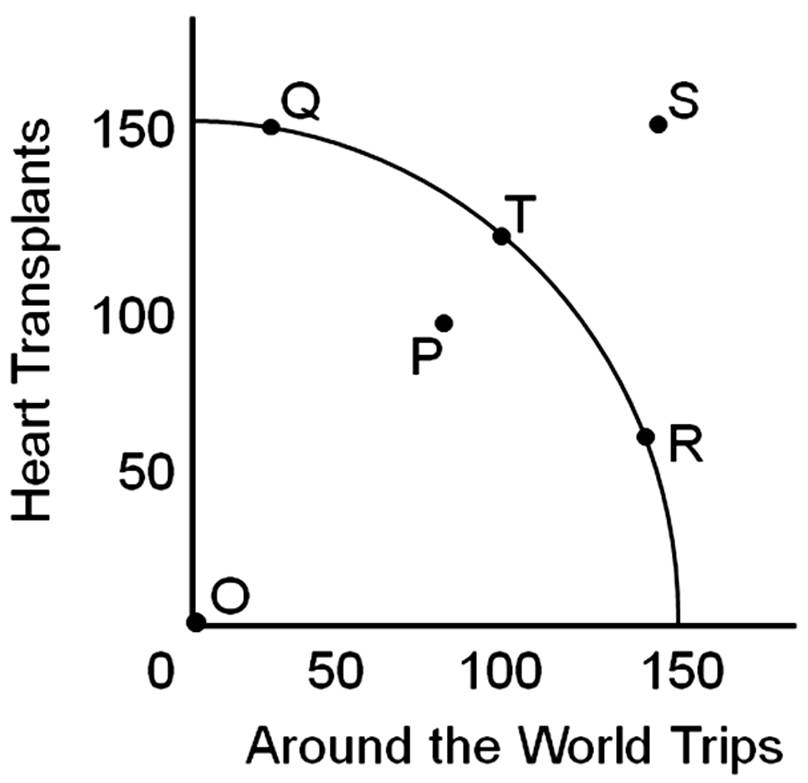

The opportunity cost of moving from point T to point Q would be

A. giving up trips around the world.

B. giving up heart transplants.

C. gaining trips around the world.

D. gaining heart transplants.

Which of the following is correct?

a. No forms of capital income are taxed twice. b. The tax code cannot be rewritten to provide greater incentive to save. c. Means-tested benefits increase the incentive to save. d. There is a correlation between national savings rates and measures of economic well-being.