If Hermione pays $10.00 in taxes on $100 of income and $10.25 on $101 of income, which of the following is not true?

A. Her marginal tax rate at $100 is 25 percent.

B. Her average tax rate at $100 is 10 percent.

C. She faces a progressive tax.

D. Her marginal tax rate at $100 is 10.25 percent.

Answer: D

You might also like to view...

The table below shows the weekly demand for hamburgers in a market where there are just three buyers.PriceQuantity Demanded by Buyer 1Quantity Demanded by Buyer 2Quantity Demanded by Buyer 3$6746597841510123211516Refer to the table. If the price of a hamburger decreases from $5 to $3, then the weekly market quantity of hamburgers demanded will

A. increase from 120 to 156. B. increase from 24 to 52. C. increase from 29 to 55. D. decrease from 52 to 24.

Referring to the graph above, assume that, at first, the labor market is in equilibrium at point 4. In which scenario does unemployment rise, with no change in the quantity of employment?

A) real wage rises to the level of points 1 and 2 B) supply shifts to pass through point 5, with no change in the real wage C) demand shifts to pass through point 3, with no change in the real wage D) supply shifts to pass through point 3, with no change in the real wage

In the mid-1830s, the U.S. entered an inflationary period that culminated in the depression of 1839-1843 . Contemporary economic historians attribute this economic downturn to

a. the demise of the Second Bank of the U.S. in 1832. b. over-issue of gold coins by the U.S. Mint. c. over-expansion by the manufacturing sector. d. external forces, including large inflows of specie from Mexico and Europe.

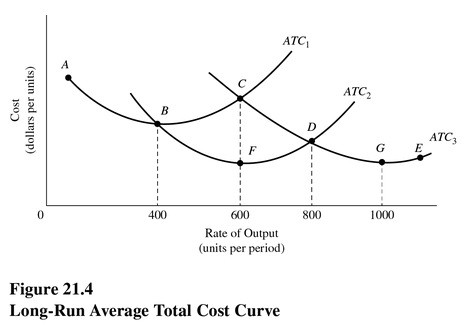

In Figure 21.4, a firm that produces over 800 units of output should choose a plant with which short-run average total cost function?

A. ATC3 only. B. Either ATC2 or ATC3. C. ATC1 only. D. ATC2 only.